How SharkShop Helps You Recover from Credit Mistakes

Are you feeling the weight of past credit mistakes? You’re not alone! Many people find themselves struggling with the repercussions of financial missteps, but there’s good news: SharkShop is here to help you turn things around. Imagine a partner that not only understands your unique challenges but also provides tailored solutions to get your credit back on track.

In this blog post, we’ll dive into how SharkShop.biz can empower you to recover from those pesky credit blunders and set you up for a brighter financial future. Say goodbye to stress and hello to second chances—let’s explore how you can make the most of what SharkShop has to offer!

Introduction to SharkShop and its services

Credit mistakes can feel like a heavy weight, dragging you down and affecting every aspect of your financial life. You might find yourself struggling to get approved for loans or facing higher interest rates, which only adds to the stress. But what if there was a way to lift that burden? Enter SharkShop—a trusted partner in credit recovery that offers tailored solutions designed to help you regain control over your finances.

With its innovative services and expert guidance, SharkShop.biz is not just about fixing credit scores; it’s about empowering individuals on their journey toward financial freedom. Whether you’ve made minor missteps or faced significant challenges, SharkShop has the tools and resources necessary to set you back on track. Let’s dive deeper into how this remarkable service can help turn those credit blunders into stepping stones for success.

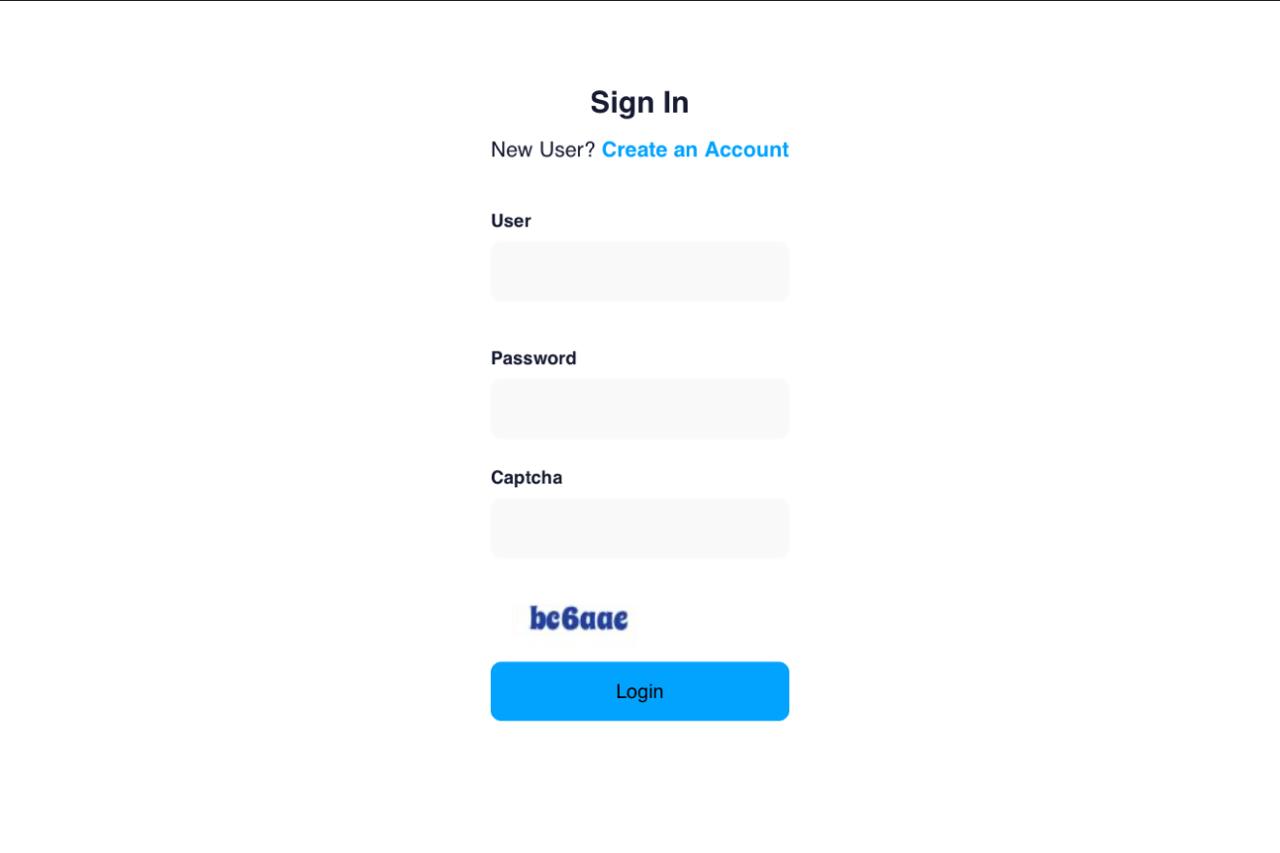

A Screenshot of Sharkshop (Sharkshop.biz) login page

The Impact of Credit Mistakes on Your Finances

Credit mistakes can have a lasting impact on your finances. A missed payment or an unpaid debt can lower your credit score significantly. This, in turn, affects your ability to secure loans and mortgages.

When lenders see a low credit score, they often view you as a high-risk borrower. This could lead to higher interest rates or even rejection of applications altogether.

The ripple effect extends beyond just loan approvals. It can also affect rental applications, insurance premiums, and even job opportunities in some fields.

As credit scores play such a crucial role in financial health, the stress from these mistakes can be overwhelming. Understanding how these errors influence various aspects of life is essential for anyone seeking financial stability and growth.

How SharkShop Can Help You Recover from Credit Mistakes

SharkShop offers tailored credit repair plans designed to meet individual needs. Each client’s financial situation is unique, and SharkShop recognizes that. By assessing your specific circumstances, they create a plan that targets the most pressing issues affecting your credit score.

Expert guidance is another cornerstone of SharkShop’s services. Their knowledgeable team walks you through every step, ensuring you understand the process and feel supported along the way.

Additionally, SharkShop provides access to valuable educational resources. These tools empower clients with knowledge about managing their credit long-term.

With a focus on personalized service and education, SharkShop stands out as an ally in recovering from past credit mistakes. You’re not just getting help; you’re gaining insights for a brighter financial future.

– Personalized Credit Repair Plans

At SharkShop, we recognize that every financial journey is unique. That’s why our personalized credit repair plans are tailored to meet your specific needs.

When you first engage with us, we conduct a thorough assessment of your credit history. This allows us to pinpoint the areas requiring immediate attention. From there, we create a customized strategy that aligns with your goals and timeline.

Whether it’s disputing inaccuracies or addressing overdue accounts, each plan is designed for maximum effectiveness. You won’t find cookie-cutter solutions here; instead, you’ll receive targeted actions aimed at improving your credit score.

Our approach ensures that you’re not just another client but an individual deserving of a fresh start in rebuilding financial health. With SharkShop by your side, reclaiming control over your finances becomes an achievable goal.

– Expert Guidance and Support

Navigating the world of credit repair can be overwhelming. That’s where SharkShop shines with its expert guidance and support.

When you partner with SharkShop, you’re not just getting a service; you’re gaining a team of knowledgeable professionals dedicated to your financial success. These experts understand the nuances of credit reporting and the complexities involved in repairing it.

They offer personalized advice tailored to your unique situation. This means no cookie-cutter solutions—just strategies that work for you.

With ongoing support, clients feel empowered rather than lost. Whether it’s explaining terminology or providing updates on progress, the communication is clear and effective.

Their commitment extends beyond just fixing mistakes; they aim to build confidence in managing finances moving forward. With SharkShop by your side, you’re never alone on this journey toward better credit health.

– Access to Credit Education Resources

SharkShop login offers a wealth of credit education resources designed to empower you. Understanding credit is crucial for making informed financial decisions.

You’ll find articles, webinars, and guides that cover a range of topics. From understanding your credit score to tips on managing debt, the knowledge available is extensive.

These educational materials break down complex concepts into simple terms. You don’t need to be a finance expert to grasp how credit works or learn about its importance.

Moreover, SharkShop provides tools that help you track your progress. Staying informed means you can make proactive choices regarding your finances.

With access to these resources, clients can feel more confident navigating their financial journeys. This foundation allows individuals not just to recover from past mistakes but also prevent future ones from occurring.

Success Stories and Testimonials from SharkShop Clients

At SharkShop, the success stories of our clients speak volumes. Many have turned their financial lives around with tailored strategies and dedicated support.

One client shared how a personalized credit repair plan helped raise their score by over 100 points within months. This transformation opened doors to better loan options and lower interest rates.

Another testimonial highlights the importance of knowledge. A single mom learned about managing her credit through our educational resources. With newfound confidence, she secured a mortgage for her first home.

Clients often express gratitude for the ongoing guidance they receive from our team. They appreciate having experts by their side, navigating complex financial landscapes together.

These inspiring journeys illustrate that recovery is possible with commitment and expert assistance from SharkShop. Each story reinforces our mission to empower individuals on their path to financial stability and success.

Tips for Maintaining Good Credit Even After Recovery

Maintaining good credit after recovery is crucial for your financial health. Start by regularly monitoring your credit report. This helps you catch any errors or fraudulent activity before it becomes a problem.

Pay your bills on time, every time. Consistent payment history can significantly boost your score over time. Setting up automatic payments can help ensure you never miss a due date.

Keep your credit utilization low, ideally under 30% of your available credit limit. This shows lenders that you manage debt responsibly.

Avoid applying for too much new credit at once, as this can lead to hard inquiries and lower scores temporarily.

Consider using secured credit cards if you’re rebuilding from scratch; they provide an opportunity to establish positive payment histories while being manageable in terms of spending limits.

Stay informed about personal finance tips to make educated decisions regarding loans and expenses moving forward.

Frequently Asked Questions about Credit Repair

Many people have questions about credit repair. It’s a complex area, and understanding it can be overwhelming.

One common question is whether credit repair services are worth the investment. For many individuals, having experts navigate the landscape of credit disputes can save time and frustration.

Another frequent inquiry revolves around how long the process takes. While every situation is unique, clients often see improvements within a few months when they stay proactive.

People also wonder if they can fix their credit themselves. Yes, it’s possible! However, professional guidance may yield quicker results and help avoid pitfalls along the way.

Lastly, some ask about costs involved in recovery services. SharkShop cc offers transparent pricing with no hidden fees to ensure clients know what they’re paying for up front. This clarity helps build trust right from the start.

Conclusion: Take Control of Your Finances with SharkShop’s Assistance

Taking control of your financial future starts with making informed decisions about your credit. SharkShop.biz offers the tools and resources necessary to navigate through the complexities of credit repair. By utilizing personalized plans tailored to your specific situation, along with expert guidance you can trust, you’re not just recovering from past mistakes—you’re building a stronger foundation for tomorrow.

With access to valuable educational resources, you’ll gain insights that empower you to make better choices moving forward. The success stories from satisfied clients speak volumes about SharkShop’s commitment to helping individuals reclaim their financial health.

Don’t let previous credit errors hold you back any longer. With SharkShop by your side, you’re equipped to create a brighter financial future filled with opportunities. It’s time to take charge and watch as your hard work begins paying off in ways you’ve always dreamed of achieving.